2024 Annual Conference

"Rejoice in the Lord: Dwell in Joy!" Is the theme of the 2025 Baltimore-Washington Conference session, which will be held Tuesday-Thursday, May 13-15, at the Hilton Hotel in Baltimore. An online PreConference Session will be held May 10 at 9 a.m.

Resolutions to be considered at this session are due Feb. 14 and should by submitted to Kevin Silberzahn, the BWC Secretary. Learn more.

News

- An Overview of the Session: Annual Conference sessions ignites spirit of vitality

- Wrap-up pdf from the Session: UMConnection Wrap-up:

- Opening Worship: Bishop LaTrelle Easterling opens BWC Annual Conference with fiery words of wisdom

- Oriole's Game: "Take us out to the ballgame!" BWC pays a visit to Camden Yards

- Service of Remembrance: BWC honors conference members with joy-filled service of remembrance

- Ministries report to Conference: Council unveils ministry data tool

- From the BWC's Queer Clergy Caucus: A statement and prayer

- Ordination: Ordination service kindles fire in set-apart servants

Photos & Videos

Worship and Plenary Sessions videos:

- Video of Opening Worship Service

- Video of May 30 Bible Study and Morning Session

- Video of Memorial Service

- Video of May 30 Afternoon Session

- Video of May 31 Bible Study and Morning Session

- Video of Ordination Service

Clergy and lay members gathered in holy conferencing at the 240th session of the Baltimore-Washington Conference on Wednesday, May 29, through Friday, May 31, at the Hilton Hotel in Baltimore.

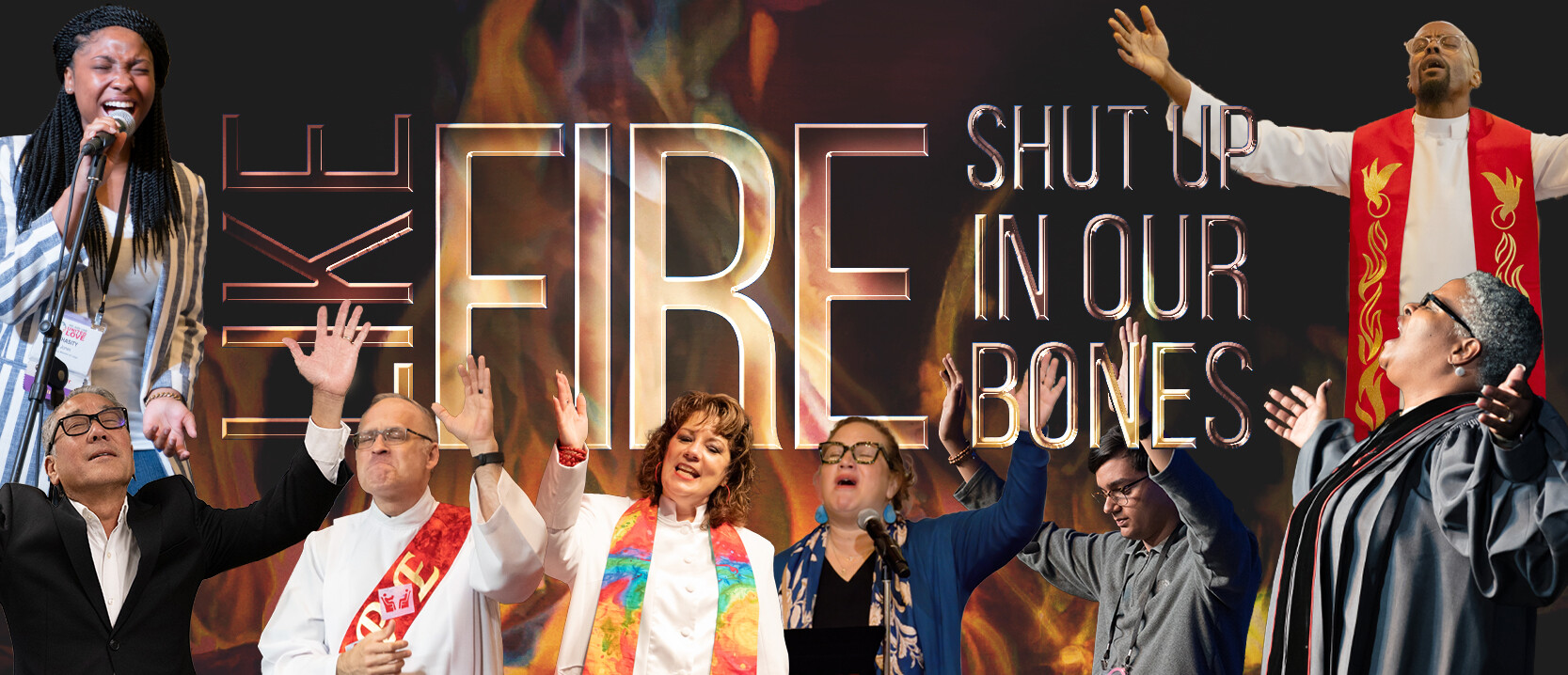

The theme of the conference, presided over by Bishop LaTrelle Easterling, was “Like Fire Shut Up in Our Bones,” inspired by Jeremiah 20:9. The guiding Scripture passage for the Annual Conference session is Romans 12:1, 9-12: "I appeal to you therefore, brothers and sisters, on the basis of God’s mercy, to present your bodies as a living sacrifice, holy and acceptable to God, which is your reasonable act of worship. … Let love be genuine; hate what is evil, hold fast to what is good; love one another with mutual affection; outdo one another in showing honor. Do not lag in zeal, be ardent in spirit, serve the Lord. Rejoice in hope, be patient in suffering, persevere in prayer.”